It starts with you

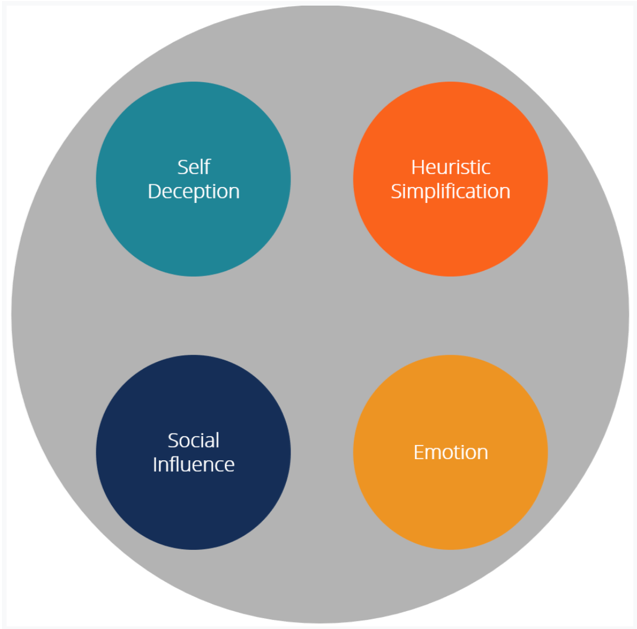

Cognitive biases are the unconscious drivers that influence our judgment and decision-making

Individuals are consistently poor in their awareness and control of their own biases

Implications for:

Some examples

In the comfort zone

A salesperson in an investment firm spends most of his time calling on clients in his home city, because he feels he knows the area best, even though there are significantly bigger clients in other cities in his territory. He’s unaware of being biased and that it’s costing himself and his firm significant revenue.

Finding people similar to you

A fund manager is in the process of hiring a new employee. While reviewing resumes, she unconsciously prefers candidates of a similar age and background to those already on her team. The manager tells herself that she is working to build a cohesive team, unaware that she is biased or, as a result, that her team will make worse decisions.

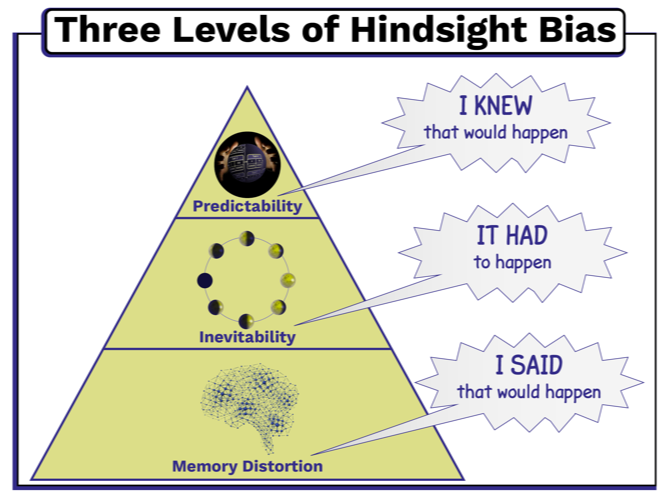

Basing new actions on past ones

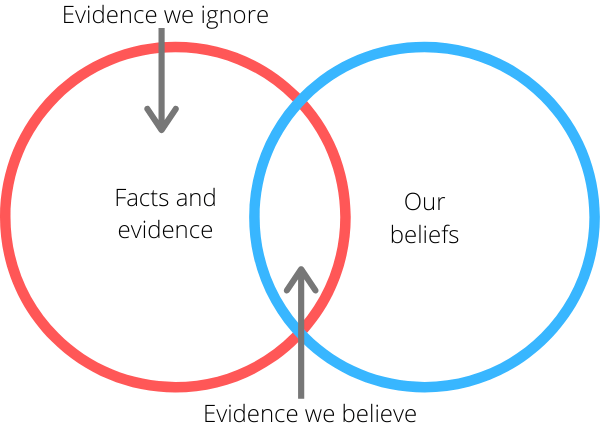

Several years ago, a senior executive in a real estate investment firm vetoed investing in a new development project. Now market conditions have changed and its clear the project would now be an amazing fit to add to the portfolio. When the project is presented again, he easily recalls the older data upon which he decided to veto the idea. Newer data, which he doesn’t know as well, clearly shows the project is now a good investment. To add to this, he has no idea that he is biased or that a business opportunity will be missed.